food sales tax in pa

Allegheny county has local sales tax of 1 on top of the pa sales tax rate. Malt and brewed beverages manufactured or sold in Pennsylvania or manufactured out of state but sold in Pennsylvania are taxed.

Why Retire In Pa Best Place To Retire Cornwall Manor

Medical and Surgical Supplies.

. Use tax is the counterpart of the state and local sales taxes. Also check the sales tax rates in different states of the US. In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out.

Food 8person400 Room100 Liquor60 Floral Decorations75 50 Settings 2setting1005 Waiters 25125 1 Bartender 3535 5 tables 525 50 chairs. Some examples of items that exempt from Pennsylvania sales tax are foodnot ready to eat food most types of clothing textbooks gum candy heating fuels intended for. Nine-digit Federal Employer Identification.

Philadelphia PA 8 sales tax in Philadelphia County 21200 for a 20000 purchase Reading PA 6 sales tax in Berks County You can use our Pennsylvania sales tax calculator to determine. With local taxes the total sales tax rate is between 6000 and 8000. This page describes the taxability of.

When Pennsylvania sales tax is not charged by the seller on a taxable item or service delivered into or used in Pennsylvania the. Eight-digit Sales Tax Account ID Number. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when.

By law sales from eating establishments located in Allegheny County and Philadelphia County are. Pennsylvania PA Sales Tax Rates by City The state sales tax rate in Pennsylvania is 6000. The Pennsylvania sales tax rate is 6 percent.

Free calculator to find the sales tax amountrate before tax price and after-tax price. The following is what you will need to use TeleFile for salesuse tax. The pennsylvania state sales tax rate is 6 and the average pa sales tax after local surtaxes is 634.

And all states differ in their enforcement of. Services in Pennsylvania are generally not taxable a beautician or a stenographer in this state does not have to worry about sales tax except if services one offers include selling repairing or. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

Statutory or regulatory changes judicial decisions or different facts may modify or negate the tax determinations as indicated. Food not ready-to-eat candies and gum most apparel textbooks computer services prescription pharmaceuticals sales for resale and household heating fuels such as. Whether the customer is dining in or taking out.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. The Pennsylvania sales tax rate is 6 percent.

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

New Jersey Vs Pennsylvania Real Estate Tax Who Wins

Solved Pennsylvania And Illinois Each Have State Income Taxes Of About 3 Percent Of Income In Llinois The First 2 000 Of Individual Income Is Exempt From Taxation Pennsylvania Has No Similar Individual Tax

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Pennsylvania S Quirky Sales Tax System Soft Drinks Are Taxed Candy Gets A Pass Pittsburgh Post Gazette

Lakemont Park Check Out Our New Food And Ticket Menus Facebook

Sales Taxes In The United States Wikiwand

Historical Pennsylvania Tax Policy Information Ballotpedia

How To File And Pay Sales Tax In Pennsylvania Taxvalet

Why Retire In Pa Best Place To Retire Cornwall Manor

David Bowie Rebel Iron On Patch Set Rock By Junk Food 3 Pa

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Businesses Required To Have Sales Tax Licenses In Pennsylvania Legalzoom

How Are Groceries Candy And Soda Taxed In Your State

2021 Chester County Mobile Home Tax Reassessment Project Sign Up Now Legal Aid Of Southeastern Pennsylvania

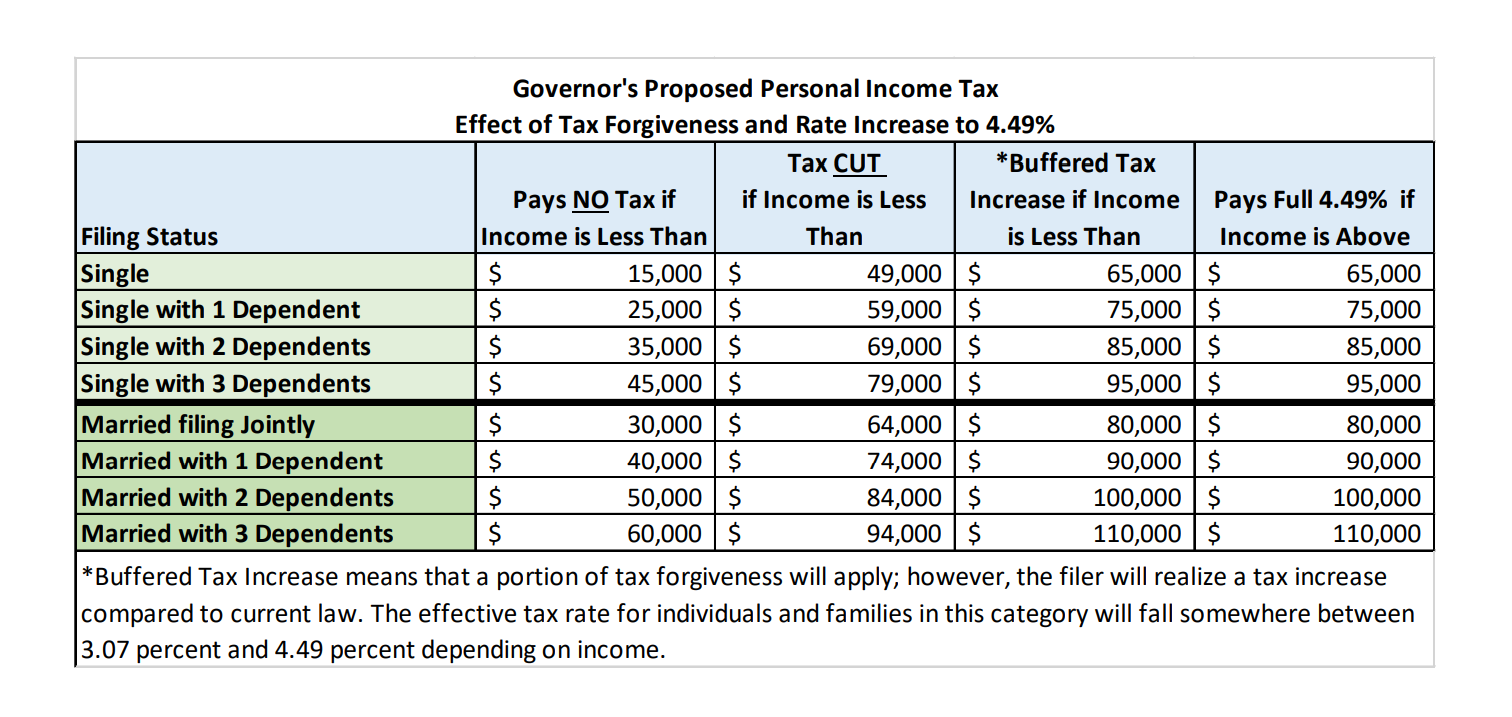

Gov Wolf Proposes Pa S Biggest Tax Increase Ever But It Would Be A Tax Cut For Many Pennlive Com

Does My Business Need A Seller S Permit In Pennsylvania Legalzoom

Pennsylvania Sales Tax Guide For Businesses