non filing of income tax return notice under which section

Common Income-tax Return proposed by CBDT for all type of. Click here to login to efiling website Below is the screen shot of the page for y See more.

Tax Talk Did You Get An Income Tax Notice After Filing Itr The Financial Express

Login to the e-filing website using the link below.

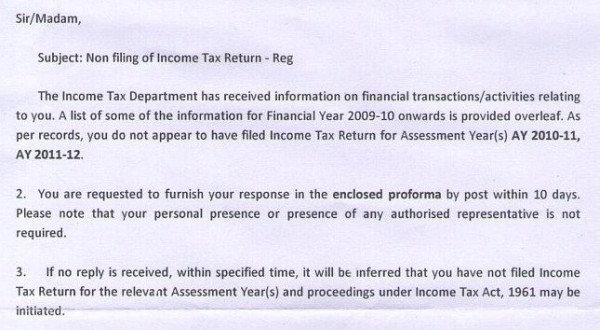

. The First relief in the above notification that has provided states that a non-resident individual or foreign company would not be required to file Income tax return if they only earn. Section 276CC is attracted for any of the various defaults by the taxpayer. Notice for Not filing Tax Returns.

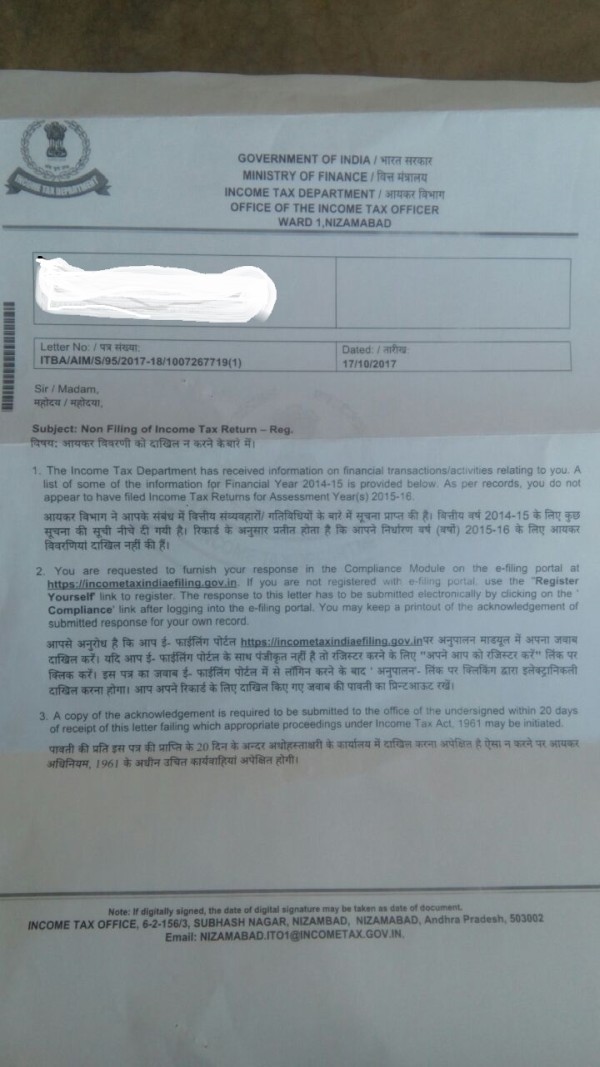

Under this section details of non-filing of Income tax returns will be furnished. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A. In case of discrepancy in filing of tax return notice under section 1399 is received.

If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. You get a defective return notice under section 139 9 of the Income Tax Act. To take swift action against non-filers the income tax department has introduced a.

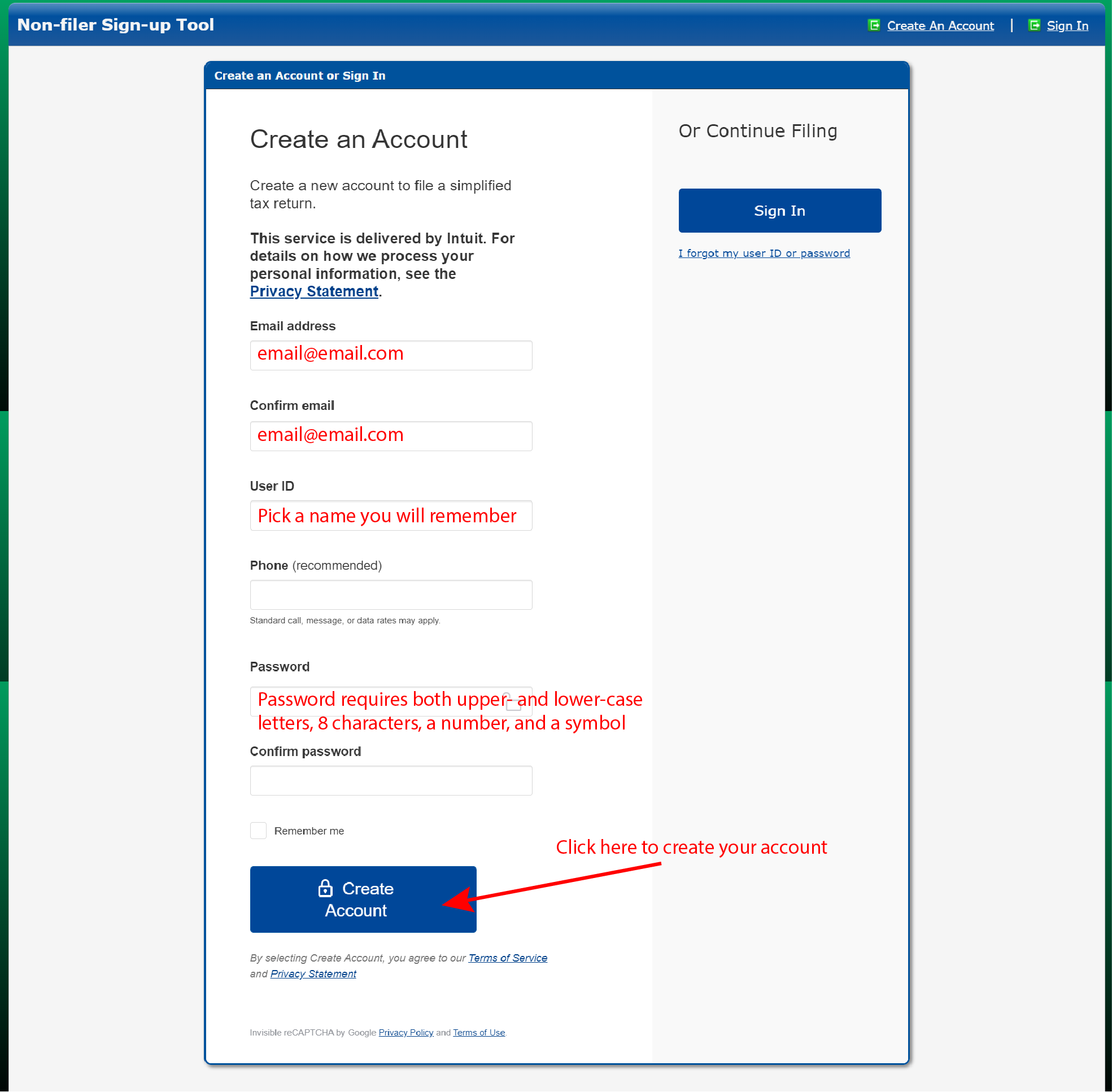

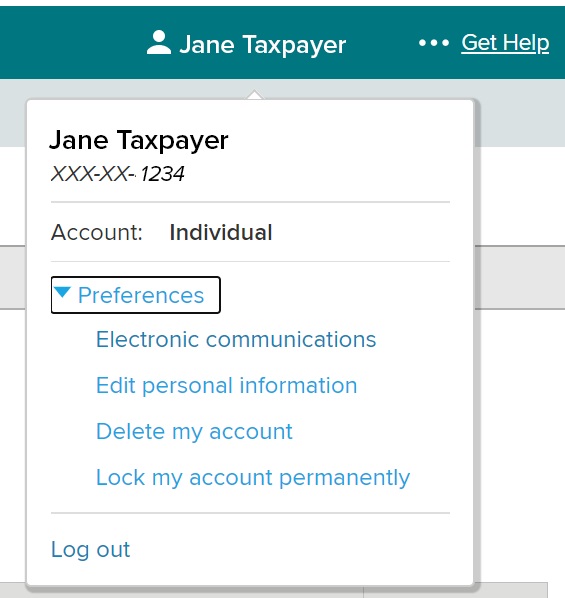

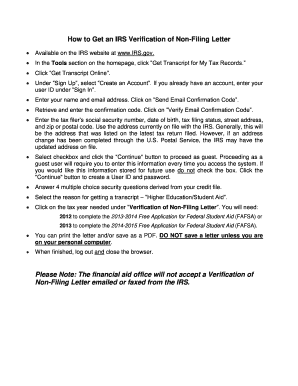

At the e-filing portal you must first register yourself. Furnish the appropriate reasons for not filling the Income Tax Returns. You can reply to the notice through the e-filing website by following the steps mentioned below.

You get a defective return notice. You can find another. Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer.

All groups and messages. Mistakes can include these things-If wrong ITR form is used. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was.

The income tax department may issue a notice under Section 271F for not filing ITR. If you have been filing income tax returns and irrespective of genuine reasons fail to file the income tax department can issue notice to you us 1432 of. Select the checkbox on the right hand side for Verification of Nonfiling.

How Should You Respond To A Defective Income Tax Return Notice All You Need To Know About Income Tax Notice Paisabazaar Com How To Reply Notice For Non Filing Of. IRC 6651a1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause. If the assessing officer feels some income.

Condonation of delay under section 1192b of the Income-tax Act 1961 in filing of Form No10A till 25112022. How the Income Tax Department Tracks Non-compliance and Non-filing of Returns. In the majority of cases the Income Tax Department sends the notice through an SMS or email.

If you choose other then switch to. However if you are already registered you must log in using your PANThen choose Income Tax Return from the drop. If the tax is not paid in.

Section 276CC provides for imprisonment in case of failure to file the return of income. Section 1432 Notice under this section is received. Contact us for ease in filing returns.

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd

Respond To A Letter Requesting Additional Information

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

How To Fill Out The Irs Non Filer Form Get It Back

How To Respond To Non Filing Of Income Tax Return Notice

Does Everyone Need To File An Income Tax Return Turbotax Tax Tips Videos

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

Understanding Notice Under Section 143 1

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

Non Filing Of Service Tax Return Email Notice Solutions Myonlineca

Penalties For Filing Your Tax Return Late Kiplinger

Income Tax Notice 10 Reasons Why You May Get A Notice From The Income Tax Department

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

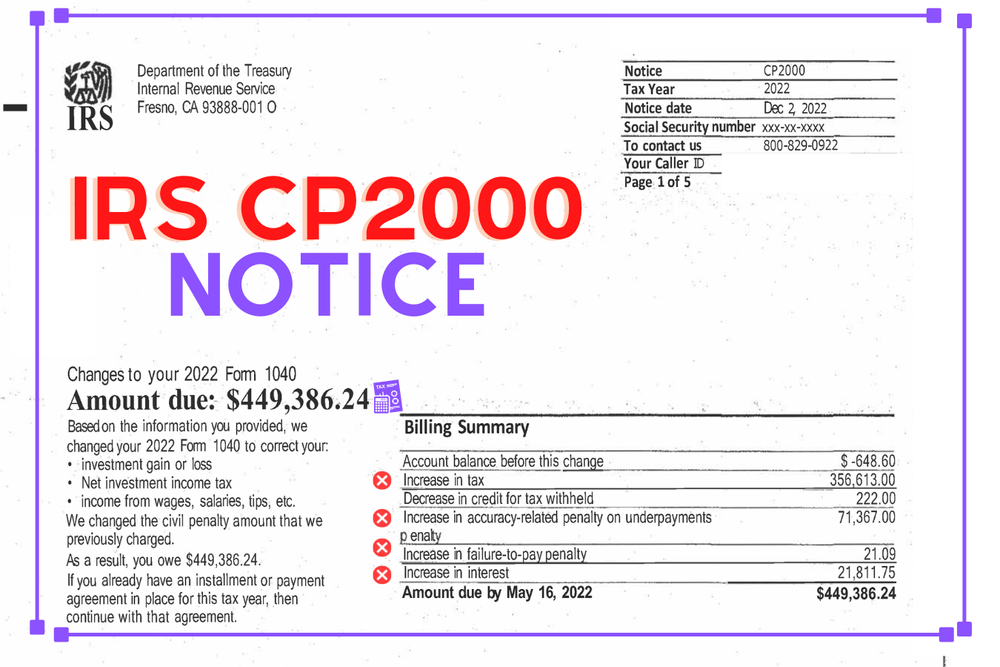

Irs Cp2000 Notice Irs Proposed Changes Can Be Reversed And Eliminate Tax Interest Penalties

Additional Information About New York State Income Tax Refunds

Income Tax Notice Received Without Mentioning Section Income Tax Itr

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

Irs Automatically Postpones Due Date For Filings And Payments Center For Agricultural Law And Taxation